Abstract: In order to study the way in which in the contemporary world profits are ‘washed’ as a result of illegal activities and the routes that money go through, involves complex investigations and a considerable amount of work. Countries that have regulated as a independent criminal offense, the offense of money laundering, have also included in its scope those actions taken to achieve hiding the illicit origin of values from committing this offense. The mixing of legal and illegal profits and the reporting of the total earnings from the business as the legal means for money laundering. Through this practice, all cycle stages of money laundering are combined .Financial funds are spaced from crime, hidden in legitimate business accounts and then brought back to the surface as legal earnings of a company. The reason is plausible: maximizing profits and available cash.

Keywords: organized crime, illegal financial system, tax evasion, money laundering, transnational terrorist infiltration in the economy.

1. INTRODUCTION

In specialized literature “the method of money laundering,” means the individual techniques and recycling schemes. A technique of money laundering, is a single procedure, while a schema involves a series of procedures whereby the profits of an illicit operations are translated into legal profits. Money laundering is more than just contraband or conceal illicit funds, although such actions may constitute essential components of the process. A logical way to distinguish money laundering from one of its component parts is to emphasize the difference between hiding the existence of money resulting from crime and disguise their nature.Some of the most popular illegal operations, such as drug trafficking continue to be profitable, but a relatively new phenomenon is the transport or trafficking illegal immigrants. This activity, which combines the growing movement of people with criminal activity is often characterized by a deeper involvement of organized crime groups.

2. MONEY LAUNDERING METHODS AND ROUTES OF ILLICIT FUNDS USED FOR FINANCING INTERNATIONAL TERRORISM

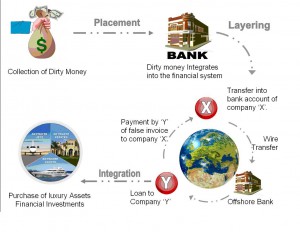

In order to achieve an effective study and to understand the specific routes followed by illicit funds, it is necessary to highlight the way in which members of criminal organizations work when it comes to recycling illicit amounts of money, in order to give the appearance that those funds are obtained legally. In practice several ways of money laundering, are known, as follows:

a) Money laundering involving politically exposed persons (PEP). According to members of the Committee of Experts for evaluating the implementation of the anti-laundering measures1 , corruption and bribery offered to public officials are two of the four sources of dirty money, the other two sources being drug trafficking and human trafficking (PC-R-EV, 1998:1). In terms of financial offenders, drug dealers or traffickers, the criminal activities undertaken by them are exposed to lower risks if certain public figures are persuaded to cooperate. Therefore, corruption of civil servants has become an important part of the criminal activity. The bribe often takes the form of cash, forcing the recipients of these “gifts” to strive in order to launder illegally obtained revenues (PC-R-EV, 1998:1).

Depending on the degree of the socio- economic development of a country, four types of corruption have been identified (Johnston, 2007:23): corruption related to the exercise of a dominant area; group leaders corruption, corruption commonly used by criminal groups, corruption of high public officials. Is not neglected the fact that due to the special status of politically exposed persons, some financial institutions are tempted to give them a wide margin of discretion in carrying out financial activities, discretion that can sometimes be used for criminal purposes (FATF, 2004:19). According to experts of the Financial Action Task Force (FATF) the sources of illegal money subjected to recycling by politically exposed persons are not only bribery, the receival of undue benefits or rewards obtained illegally. Politically exposed persons from countries where corruption is endemic are likely to be directly involved in running criminal activities related to organized crime. On the other hand, in almost every country politically exposed persons can be identified carrying out suspicious activities (FATF, 2004:19). According to FATF experts, there are at least two ways of detecting the illegal activities of politically exposed persons. The first is the change of power in a country in which a PEP operates illegally while the regime that succeeds to power promotes a policy of settling of scores. The second way concerns the discovery of some indicators regarding the conducting of suspicious transactions in financial activities carried out by them (FATF, 2004:22). Depending on the criminal culture of various politically exposed persons, FATF experts have identified four types of money laundering: money laundering obtained through corruption, by association with a politically exposed person; laundering money from embezzlement, money laundering obtained through diversion of public funds through the family members of a PEP, money laundering obtained through high-level corruption.

b) Money laundering through real estate investments – investing money in real estate is a technique frequently used for money laundering. As recently confirmed by the FATF, these investments are a classical method, tested in a while to launder illegal money. The typological review of cases reported by CTIF-CFI confirms that several techniques used for laundering money of illicit origin involves the real estate sector. The used techniques, vary from relatively simple to very complex, involving large sums of money. Details regarding these techniques are described below. The use of non-financial professions – to evade anti money laundering measures, those who carry out this activity had to develop increasingly complex methods. Criminals who wanted to recycle criminal income have oriented towards the experience of the professionals. This trend has been observed internationally and is becoming increasingly common in money laundering operations. Lawyers, notaries, accountants and other professionals perform a series of tasks that criminals target them in order to use their knowledge and to put in place a money laundering mechanism with an illegal origin. The typological review of recorded cases has focused on the services most used by those who recycle the money. These are explained below in accordance with the extent to which non-financial professions are involved in money laundering ranging from minimal to very intensive.

Submission to the financial institutions – in order to avoid awakening suspicion about their criminal activities, those who recycle money use non-financial professions to be presented to financial institutions. When a person engaged in non-financial profession presents the client of a financial institution, this client will present credibility due to the ethical standards associated with such occupations.

Engaging in real estate transactions – different non-financial professions were faced with money laundering activities because of the key role they play in such transactions. When they are exercising their profession they are in a favorable position to record any irregularities that would create suspicions regarding money laundering.

Execution of financial transactions -, non- financial professions can perform various financial transactions for their customers (eg cash deposits, issue or withdrawal of checks). They can also carry out transactions through accounts opened in their name, but for those who recycle money. Using the account of a non-financial professional as transit account is meant to conceal the identity of the ultimate beneficiary and the link between the illicit origin and the destination of the funds.

Establishment of corporate structures and legal financial constructions – those who recycle money also turn to non-financial professions to establish corporate structures and legal financial constructions to make transactions as obscure as possible. Complex corporate structures and legal financial buildings are designed to conceal the true identity of the beneficiaries. Some files concerning the use of the established legal financial construction of self non-financial professions have shown that they can play an active role in money laundering.

The use of corporate structures – the use of fake companies is a money laundering technique that hides the origin of the funds and which increases the anonymity of transactions partners or beneficiaries. When using shell companies concerns should arise regarding financial institutions and non-financial professions. Beyond buildings using off-shore companies, financial experts and lawyers are sometimes used to make the scheme more complex and less transparent. Using obscure legal structures, such as trust funds, helps hiding the identity of the real beneficiaries.

Acquisition of immovable property of great value – through the purchase of immovable property of great value, large sums of money from criminal activity can be converted into bona fide securities and invested in the legal economic system. The acquisition of such property, especially where there is no clear economic justification, should lead to further investigations authorized entities.

Buying or selling above or below market value – it was discovered that another technique used in money laundering through real estate investment is the sale or purchase of a property above or below its market value. It is also suspicious the repeated sale of a property with unusual profit margins when one can not provide a plausible explanation for these transactions.

Using intermediaries for real estate acquisitions – in some cases, the person involved buys properties on behalf of third-parties, with which he has no connection. Thus the person who recycles money wants to hide the connections between him and transactions used for “laundering” money, using a middleman or a front man.

The use of suspense accounts – another identified technique used in money laundering is the use of suspense accounts. Funds usually arrive in the accounts by deposits, transfers, checks or international transfers. They never remain in the same account for a long period of time. Analyzing these accounts has led to the conclusion that they were formed solely for the purpose of such transactions.

The distorted use of mortgage – contracting a mortgage loan repaid through bank deposits is a technique through which money illegal origins is injected into the financial system on a regular basis, with the aim of recycling it.

c) Laundering money resulted from corruption uses the following techniques at least:

Banking Transactions – those who recycle money originating in corruption prefer to use the banking system in their operations. They often use bank accounts for the sole purpose of engaging in used in money laundering process.

Making liquidity transactions and international transfers – the classical scheme of these operations generally consists either of cash deposits followed by transfers abroad or from transfers outside the country followed by cash withdrawals. The purpose of making cash deposits and cash withdrawals is to disguise the origin and the destination of the funds. Using international transfers allows one to add a transnational dimension to the operations, in order to cover the traces. It is well known that those who recycle money prefer to delimit the criminal activity from money laundering .

Using third-party or non-financial professions – although in most cases money laundering is carried out by corrupt individuals there are plenty of situations where such activities are carried out by third-parties, such as family members or close people , especially when involving politically exposed persons.

The private banking – private banking system has been used for money laundering operations related to corruption. Most reported cases have shown the use of banking services abroad.

The use of suspense accounts, shell companies and offshore companies – in many cases complex techniques of money laundering are used in order to increase the difficulty in detecting these operations. Thus, some people open accounts abroad in the name of ghost companies, which use them as transfer accounts to move funds from and / or to foreign countries, especially offshore centers.

Investments in real property, real estate and insurance business – these allow large masses of illegal money to be wagered legally in the financial circuit.

d) Money laundering originating from fraud – people who recycle money arising from fraud using the following techniques:

Using the banking system, respectively through the accounts they have opened in more than one bank units – opening a large number of accounts at the same bank branches and disposal of repeated transfers of large sums of money between accounts, frequent deposits of cash on behalf of clients by third parties, without apparent connection with the recipient account are some of the techniques used.

Investing money from fraud involves the purchase of land or buildings which are then resold for profit.

Simulation of trade and international economic and financial operations – this involves using commercial relations that any country has, while conducting false financial operations . Thus, the operators involved in money laundering, in agreement with some “trading partners” conduct extensive import- export activities that either do not occur in reality or are held in values and quantities different from those contained in the financial documentation submitted to the custom authorities. In this context, certain company will proceed to a purchase from the country in which it is established, e.g. a machine , in exchange for a certain sum (which comes from illegal activities). Subsequently, this good is subject to a succession of sales of several companies that actually were created specifically for this purpose. Successive sales finally lead to a dramatic and artificial increase of the value of the machine, which is finally exported and financial authorities of that particular state shall be obliged to reimburse the VAT, which is often 2-3 times higher than the real value of the exported machine. Moreover, the overseas company unit which is acquiring the machine is property of the same criminal network so the initial capital used to purchase equipment can Sbe recycled back home and can be introduced without problems in the legal economic circuit.

Legally addressing the phenomenon it becomes evident that on the one hand the state is subject to VAT liability of certain economic and financial offenses (forgery of official documents, forgery, fraud and so on), and on the other hand recycling and reintroducing the initial capital in the economic circuit leads to the offense of money laundering.

e) Money laundering originating from drug trafficking – in the drug business drug dealers earn relatively small amounts money but in many locations. The money thus obtained are invested in activities such as restaurants, very suitable for money laundering. The advantage is that the flow of circulating money is very large. Criminals can also periodically declare additional revenue in addition to legally obtained revenues. The disadvantage is that illicit money are taxed along with legally obtained capital. Mixing legal money with illegal money has the advantage that it provides almost immediate explanation for the origin of large sums of money – profits arising from lawful activity. The method used is chosen depending on the criminal activity and institutional status of the country in which illegal money are obtained. Also, money deposits (so called smurfing method) and illegal gambling are often used. Obviously these methods clearly show that there are many ways to recycle money. As mentioned, it would be much easier to reduce criminal activity than to fight against these methods. Fight against terrorist financing concerns worldwide organizations including the International Financial Action Task Force (FATF / FATF) which decided to extend the mandate at a special session in Washington in October 2001. Thus, the FATF adopted a set of nine Special Recommendations to stop terrorist organizations in obtaining and transferring funds for their criminal activities. Such recommendations are the new international standards for combating terrorism. These countries prohibit the use of alternative money transfer and other informal or underground banking systems. In addition FATF called on its members to strengthen customer identification measures for wire transfers and prevent charitable donations to be used for terrorist financing activities. In this respect the FATF has invited countries to ratify the UN Convention the Suppression of the Financing of Terrorism and implement relevant Security Council resolutions.

In Romania, the issue of terrorism is addressed from the prevention perspective , which involves focusing on preventing terrorist activities, human resources supply, logistics and finance. Consequently, the institutions involved in the National System for the Prevention and Combating of Terrorism (NSPCT) actively participate according to areas of competence to halt the activities of terrorist groups funding , working with the National Office for Prevention and Control of Money Laundering in the identification of suspected terrorist financing operations. National Strategy for preventing and combating terrorism (since 2002) and Law no. 535/2004 on preventing and combating terrorism set the following major objectives and supporting actions in preventing and combating the financing of terrorism: protecting national territory associated with terrorist activities, protection of Romanian citizens and foreign objectives of activities subsumed / Associated terrorism regardless of origins and forms of manifestation, preventing the involvement of Romanian citizens and foreign residents in Romania in activities subsumed / associated with international terrorism, regardless of the area of development, the objectives or their targets, participation in international efforts to prevent and combat terrorism in different geographical areas.

At the same time, nationally, the crime of “terrorism financing” is incriminated in the Article 36. 1 of Law no. 535/2004 on preventing and combating terrorism, article referred by Special Law no. 656/2002 on preventing and sanctioning money laundering as well as on establishing measures to prevent and combat terrorist financing, as amended and supplemented, at art. 2 letter. a1: “Providing a terrorist entity movable or immovable goods, knowing that they are used for supporting or committing terrorist acts, and acquiring or collecting funds, directly or indirectly, or performing any financial operations bank to finance terrorist acts, shall be punished with imprisonment from 15 to 20 years and interdiction of certain rights.”

Activity of money laundering is inseparably linked to organized crime, because organized crime activities generate large amounts of money, which, in order to be used should be washed to conceal their illegal origin. Large amounts of money from illicit affairs are used for internal expenses of the criminal network, which consist of payments paid to suppliers, associates and for bribing officials – distribution of the money does not leave too many traces, as the money enter the circuit legal directly as current expenses.

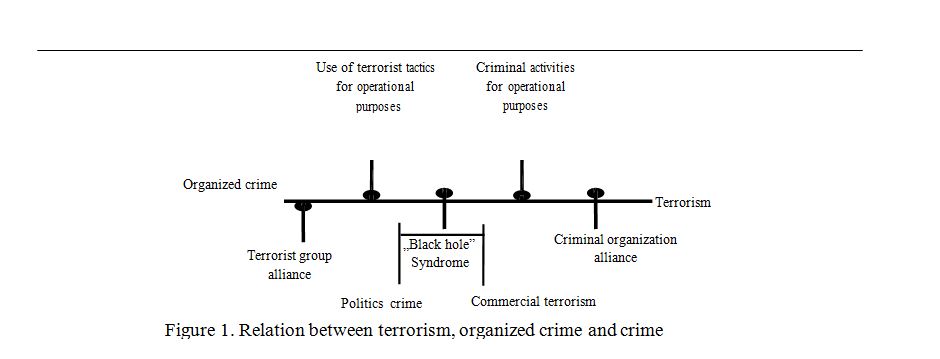

Phenomenon of money laundering has made geographical boundaries to become practically insignificant because members of criminal organizations prefer to send their illegal income to countries where measures to control this crime are little or no effective. Under these circumstances, illicit income is sent to Central and Eastern Europe or to countries with poor law in Asia and Africa and is deposited in the financial centers and banks in territories known as “tax havens” where anti-money laundering regulations are ineffective. The relationship between terrorism, organized crime and crime can be described according to Figure 1, as follows:

Sources of terrorist financing are used through formal and informal systems , come in a variety of origins, from crimes or not. The most important are: human – individual and common (corporate) voluntary contribution; Diaspora (migrant communities with voluntary contributions) ; ethnic and religious support (donations and contributions from people with religious and ethnic affinity) ; state partnership (the state supports the terrorist group ) ; public and private donors and individual donors supporting terrorism, social and religious organizations; high-level organized crime (fraud, drug production and trafficking, kidnapping, armed robbery, person trafficking); investment and legal affairs (money are used for the acquisition of companies and their involvement in profitable business to fund terrorism) ; NGOs and community organizations (terrorist organizations create phantom organizations that receive funds from twin NGOs from other countries or infiltrate into community organizations that receive funding).

3. CONCLUSION

To improve the methods of preventing money laundering the governmental authority must be very receptive to the use of the most appropriate financial mechanisms and taxation, leading to discouraging crime and to encouraging the timely reporting of unusual transfers / illegal money. An effective mechanism for capital and financial markets is necessary in order to implement a complex and continuous supervision the ongoing money laundering used for financing international terrorism. Extending control of corruption in the public sector and financial and audit control of economic activities in order to prevent tax evasion and eliminate or reduce economic underground activity. Creating a force “of intervention” for the tax sector in order to combat money laundering (a kind of tax Interpol).

BIBLIOGRAPHY

1. Frunzeti Teodor, Zodian Vladimir. (2011).

Lumea 2011. Enciclopedie politică şi militară. Bucharest: CTEA.

2. Fulga, Vasile. (2009). România raportată la fenomenul teroris internaţional.

Bucharest: CTEA.

3. Johnston, Michael. (2007). Coruption and its types. 300.

4. ***. (1998). The Summary Report of the PC-R-EV- Typologies Exercise (PC-R- EV).

5. Popa, Ştefan, Cucu, Adrian. (2000).

Economia subterană şi spălarea banilor.

Bucharest: Expert Publishing House.

6. Suceavă, Ion, Coman, Florian. (1997).

Criminalitatea şi organizaţiile interna ionale. Bucharest: Romcart Exim.

7. Voicu, Costică. (2006). Criminalitatea organizată în domeniul afacerilor. Bucharest: Pildner.

8. ***. (2004). FATF Report on Money Laundering Typologies2003-2004. Polilicall Exposed Persons Section.

1 It is a Sub-Committee on Crime Problems (CPDP) body of the European Council. The Committee of Experts presented for the first time, typologies of money laundering in 1998. Today checking the implementation of this measures by States to prevent and combat money laundering fall within the functions of MONEY VAL.

Articolul a fost publicat in Revista Academiei Fortelor Aeriene ,,The Scientific Informative Review, Vol X, No 2(21)/2012″

Leave A Comment